Get Free Demo to our Portal to Manage your Entity or Start a Local Business.

Private limited liability companies (BVs) and public limited liability companies dominate Belgium. BVs are more flexible and require less share capital than NVs, but both give limited liability protection.

A Belgian Business Identification Number (KBO number) and registration with the Belgian Crossroads Bank for Enterprises are required to start a business in Belgium. Businesses operating in Belgium must also understand Belgian taxation regulations, financial reporting requirements, and tax treaties with other countries.

Tax incentives and double taxation treaties make Belgium attractive to foreign companies. Starting and running a Belgian business requires understanding these aspects.

At our organization, we provide comprehensive Entity Management services for clients worldwide, including businesses from non-EU countries. Our goal is to simplify the company registration process in Belgium, ensuring a seamless experience for international entrepreneurs.

In Belgium, the most common types of company structures include:

SRL (Société à Responsabilité Limitée): A limited liability company, ideal for small to medium-sized enterprises. It requires a minimum capital of €18,550, with at least €6,200 paid up at incorporation.

SA (Société Anonyme): A public limited company suitable for larger businesses, requiring a minimum capital of €61,500. This structure allows for shares to be publicly traded.

SCS (Société en Commandite Simple): A partnership structure that includes at least one general partner with unlimited liability and one limited partner whose liability is limited to their contribution.

Sole Proprietorship: A straightforward structure for individual entrepreneurs that provides complete control but also entails personal liability.

Our Overview of Company Registration in Belgium service offers essential guidance on the necessary steps, documentation, and compliance requirements. By leveraging our expertise, you can confidently navigate the registration process and effectively set up your business in the Belgian market.

Successful business establishment in Belgium depends on choosing the correct company structure. Each of Belgium's several legal structures for corporations—sole proprietorships, limited liability companies (LLC), public limited companies (PLC), and cooperative societies—has advantages and drawbacks depending on the business. Our knowledge of entity management services enables us to lead you through the complexities of Belgian company legislation, therefore guiding you toward the most appropriate structure for your particular requirements and objectives.

Your company operations, tax responsibilities, and liability exposure can all be greatly impacted by the structure you choose. One needs to give much thought to elements including operational flexibility, capital needs, and ownership. Our entity business customer services for Belgium consist on thorough consultations to evaluate your particular situation and offer customised advice. We make sure you have all the knowledge required to make wise structural changes for your business, therefore setting you for long-term development and Belgian market compliance.

With our committed help, negotiating the complexity of company creation in Belgium becomes a simple process that lets you concentrate on growing and developing your company while we handle the specifics.

Our expertise extends to assisting international entrepreneurs in navigating the complexities of local regulations and establishing their presence in various markets.

One of the valuable resources we provide is guidance on How to Register a Business in Belgium by Yourself. This service empowers entrepreneurs with the knowledge and tools needed to successfully complete the registration process independently.

Step-by-Step Guide to Self-Registration

We break down the process into manageable steps, covering essential aspects such as choosing the right business structure, obtaining necessary permits, and understanding tax obligations. Our aim is to make the self-registration process in Belgium as straightforward and efficient as possible.

Starting a branch in Belgium presents companies with a big chance to access the active European market. Branch registration in Belgium is simple, which lets foreign companies grow their activities rather naturally. Our knowledgeable staff offers thorough assistance to negotiate the required legal and regulatory obligations surrounding branch establishment.

Businesses opening a branch in Belgium have to first make sure they follow local rules, including registering for the necessary permits and licenses. This covers making sure one complies with tax laws and labor rules and registering with the Belgian Crossroads Bank for Enterprises (CBE). Our entity management solutions are designed to help you at every stage of the registration process thereby guaranteeing a flawless and quick setup.

For Belgian entity company, our customer services center on providing customized solutions that satisfy every client's particular demands. From first consultation to continuous compliance monitoring, we are committed to enable companies in Belgium's dynamic economy flourish. Our local knowledge and global viewpoint enable you to boldly negotiate the complexity of branch registration and create a strong profile in Belgium.

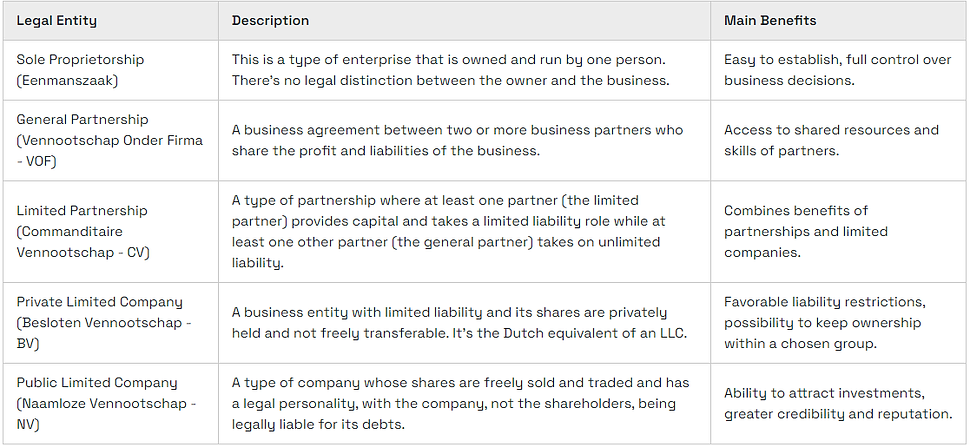

In Belgium, a variety of legal entities cater to different business needs, each with distinct structures, advantages, and requirements. Understanding these options is essential for non-residents looking to establish a foothold in this dynamic economy.

One of the most popular forms of business entities in Belgium is the BV (Besloten Vennootschap), equivalent to a limited liability company. This structure requires a minimum share capital of €18,550, making it an attractive option for small to medium-sized enterprises. The BV provides personal liability protection for its shareholders, ensuring that their personal assets are safeguarded from the company’s debts.

Another common legal structure is the SA (Société Anonyme), or public limited company, which is ideal for larger enterprises. This entity mandates a minimum share capital of €61,500 and allows for the trading of shares on the stock market. The SA structure is particularly suitable for businesses aiming for significant growth and investment opportunities.

For freelancers and sole proprietors, the sole proprietorship (Entreprise individuelle) offers a straightforward approach. This structure requires minimal registration and is easy to manage, but the owner is personally liable for all business debts.

Partnerships (Sociétés de personnes) are also prevalent in Belgium, including the SNC (Société en Nom Collectif) and SCS (Société en Commandite Simple). These entities allow two or more individuals to operate a business together, sharing profits and responsibilities.

Choosing the right legal entity is crucial for ensuring compliance with Belgian regulations while aligning with your business objectives. Our team is here to provide expert guidance, helping you navigate these options and establish a successful venture in Belgium.

Our Entity Management Services cater to global entrepreneurs, including those from non-EU countries, seeking to establish a presence in Belgium. A crucial step in this process is selecting the appropriate legal business structure. In Belgium, entrepreneurs can choose from several options, including sole proprietorships, partnerships, and corporations such as the BV (Besloten Vennootschap) and SA (Société Anonyme). Each structure has distinct implications for liability, taxation, and operational flexibility, making it essential to consider these factors based on your business goals.

Choosing the right legal structure is vital for long-term success and compliance in the Belgian market. Our expert team assists entrepreneurs in evaluating their options, taking into account factors such as ownership, funding, and administrative requirements. With our support, you can make an informed decision that aligns with your vision, ensuring a strong foundation for your business in Belgium and beyond.

Setting up a company in Belgium is a streamlined process, particularly appealing to entrepreneurs from EU countries. The Belgian government has established efficient procedures to facilitate business registration, making it an ideal location for international business ventures. Generally, the entire process can take anywhere from a few days to a couple of weeks, depending on factors such as the type of business and the required documentation.

The first step in establishing your company is to choose a legal structure. Common options include a private limited company (BV), a public limited company (SA), or a sole proprietorship (Entreprise individuelle). Each structure has its own requirements and implications for liability, taxation, and management. Once you’ve decided on the structure, you’ll need to gather the necessary documentation, such as identification, a business plan, and proof of address. Having these documents organized can significantly speed up the registration process.

Next, you will need to register your company with the Belgian Crossroads Bank for Enterprises (Kruispuntbank van Ondernemingen or KBO). This process is generally quick and can often be done online. Upon successful registration, you’ll receive a company registration number, which is essential for opening a bank account and fulfilling tax obligations. The KBO typically processes your application within a few business days, allowing you to move forward with your business operations swiftly.

After registering with the KBO, you must also obtain a tax identification number (VAT number) from the Belgian tax authorities (FOD Financiën). This step is essential for your business’s tax obligations. The tax authority usually issues this number shortly after your company registration, enabling you to start trading without unnecessary delays.

Finally, while the process is efficient, it’s important to consider any additional licenses or permits your specific business may require, depending on the industry. These can take extra time to secure, so it’s wise to research these requirements in advance. With the right preparation and understanding of the steps involved, setting up your company in Belgium can be a fast and rewarding experience, offering a gateway to the broader European market for entrepreneurs.

When establishing a business presence in Belgium, registering with the Belgian Crossroads Bank for Enterprises (Kruispuntbank van Ondernemingen or KBO) is a crucial step. This official register records all businesses operating in Belgium, ensuring transparency and compliance with Belgian laws.

Choose a Legal Structure: Determine the appropriate legal entity for your business, such as a private limited company (BV), a public limited company (SA), or a sole proprietorship (Entreprise individuelle).

Prepare Documentation: Gather necessary documents, including identification, proof of address, and details of your business activities. For foreign entrepreneurs, additional documents may be required, such as a copy of the passport and proof of residency.

Complete the Application: Submit your registration application online or in person at a local KBO office. You will need to provide specific details about your business, including the company name, address, and intended activities.

Pay the Registration Fee: A small fee is typically required for registration, which varies based on the legal structure chosen.

Receive Your Registration Number: Once your application is processed, you will receive a unique registration number, which must be displayed on official documents and communications.

For businesses based in Germany looking to expand into Belgium, the registration process can often be conducted remotely. Our entity management services offer guidance throughout the registration process, ensuring compliance with Belgian regulations and facilitating a seamless integration into the Belgian market.

Our entity management services provide comprehensive support for registering your company with the Belgian Crossroads Bank for Enterprises. We assist with documentation preparation, application submission, and ongoing compliance to ensure a smooth and efficient process. Whether you're a local entrepreneur or a foreign business expanding into Belgium, we are here to help you navigate international business registration successfully.

Here’s a step-by-step guide to help you understand how to register a firm in Belgium:

Ensure that your chosen business name complies with Belgian regulations and is unique. You can check the availability of the name through the Belgian Crossroads Bank for Enterprises (KBO).

Decide on the type of legal entity (e.g., BV, SA) and define the roles of shareholders and directors. Each structure has different implications for liability and taxation.

Create the formal documents outlining your company’s objectives, structure, and operational procedures. These documents must be notarized by a Belgian notary.

Submit your notarized Articles of Association to the Belgian Crossroads Bank for Enterprises (KBO) for registration. This step includes providing the necessary documentation, such as identification and proof of address.

After registration, apply for a VAT number from the Belgian tax authorities (FOD Financiën). This number is essential for your business’s tax obligations.

Set up a corporate bank account using your registration documents, VAT number, and proof of identity. This account will be necessary for handling your business’s financial transactions.

Implement an accounting system to ensure compliance with Belgian financial regulations and facilitate tax reporting. This will help in maintaining accurate financial records for your business.

By following these steps, you can successfully register your firm in Belgium and start your business operations smoothly.

So, what are the costs associated with setting up a business in Belgium? The fees for registration can vary depending on whether you’re establishing a branch or forming a Belgian private limited company (Besloten Vennootschap or BV).

Firstly, if you're registering a branch, the costs typically include a registration fee of around €90 to €150 with the Belgian Crossroads Bank for Enterprises (Kruispuntbank van Ondernemingen or KBO). This fee applies to all business types, including branches, partnerships, and sole proprietorships. Additional expenses may arise if you seek professional legal assistance or require translation services during the process.

On the other hand, if you're forming a BV, the costs will be higher due to the need for notarization of the articles of association. Notary fees can range from €500 to €1,500, depending on the notary and the complexity of your business structure. Additionally, you will need to have a minimum share capital of €18,550, which must be fully subscribed and deposited prior to registration.

Beyond notary and registration fees, you may also encounter costs for legal advice, drafting contracts, and potential translation services.

It's important to remember that these are just the initial costs. Other ongoing expenses to consider include annual accounting fees, tax management, and general operational costs. Thoroughly assessing your specific situation is crucial to avoid any unexpected expenses and ensure a successful business setup in Belgium.

The Belgian Business Register, known as the Kruispuntbank van Ondernemingen (KBO), is where all businesses must be officially registered. To complete the registration, you will need to submit a completed registration form, a valid form of identification, and proof of your business’s address. After submitting the necessary documents and paying a one-time registration fee, you will receive a unique KBO number, which is required for all formal business activities.

Registering with the Belgian Tax Authorities

In addition to registering with the KBO, you must also register with the Belgian tax authorities, known as the FOD Financiën. Upon registration with the KBO, your details are automatically shared with the tax authorities. You will receive a VAT number and, if applicable, a tax identification number, both of which are essential for managing your tax obligations in Belgium.

Key Points During Registration

Once registration is complete, you can officially begin your business operations in Belgium, adhering to the appropriate legal and tax frameworks.

The Belgian tax system offers several advantages for businesses, including a comprehensive network of tax treaties with various countries, which facilitates tax-efficient cross-border operations. Additionally, Belgium provides a range of tax incentives aimed at promoting research and development (R&D), making it an appealing destination for innovation-driven enterprises.

Belgian tax law allows for various deductions and special allowances, particularly concerning investment activities and R&D projects. This enables businesses to optimize their tax liabilities while investing in growth and development.

Corporate Income Tax (CIT)

In Belgium, companies are subject to Corporate Income Tax (CIT) on their worldwide income if they are resident entities. Non-resident companies are taxed only on income generated from Belgian sources. The standard CIT rate is currently set at 25%, with a reduced rate of 20% applicable to small businesses on the first €100,000 of taxable income.

Regional Taxes

Belgium has a unique tax structure, where regional taxes can apply to business income, including the provincial tax and various local taxes. Rates and regulations may vary depending on the region and municipality.

Value Added Tax (VAT)

VAT in Belgium applies to the sale of goods and services, with a standard rate of 21%. Reduced rates of 12% and 6% apply to certain goods and services, such as food and medicines. Certain international transactions may be exempt from VAT or eligible for a 0% rate.

Withholding Tax on Dividends

Dividends distributed by Belgian companies are subject to a 30% withholding tax. However, this rate can often be reduced or eliminated under Belgium’s extensive network of tax treaties or through the EU Parent-Subsidiary Directive, which aims to prevent double taxation and encourage investment within the EU.

Payroll Taxes

Employers in Belgium are required to withhold wage tax (impôt des personnes physiques or personenbelasting) and social security contributions from their employees’ wages. The wage tax functions as an advance payment of income tax and must be regularly remitted to the tax authorities.

Other Taxes

In addition to the above, businesses in Belgium may be subject to additional taxes such as property tax, environmental taxes, and local business taxes, depending on their location. Understanding these taxes is crucial for compliance and effective financial management.

Research and Development (R&D) Tax Credit

Belgium actively promotes innovation through its R&D tax credit, allowing companies to claim a significant portion of their eligible R&D expenses as a tax deduction. This incentive provides substantial savings for businesses investing in technological and scientific advancements, encouraging a robust environment for innovation.

Investment Grants for New Businesses

Belgium offers various investment grants for businesses establishing operations in specific regions. These grants are designed to help reduce the costs associated with starting and expanding businesses, particularly in economically disadvantaged areas. This support fosters regional development and stimulates local economies.

Reduced Corporate Tax Rates for Small and Medium-Sized Enterprises (SMEs)

Belgium provides reduced corporate tax rates for small and medium-sized enterprises (SMEs), allowing these businesses to benefit from a lower tax burden as they grow. This incentive is aimed at fostering entrepreneurship and supporting the expansion of smaller companies, ensuring a thriving ecosystem for new and emerging businesses.

Businesses in Belgium are required to maintain and file accurate financial records, prepare annual financial statements, and fulfill statutory reporting obligations with the relevant authorities. This includes compliance with the Belgian Companies Code and, where applicable, International Financial Reporting Standards (IFRS).

Audit Requirements in Belgium

Foreign residents establishing a company in Belgium must adhere to the same financial reporting and audit requirements as domestic companies, ensuring compliance with Belgian laws and regulations. This promotes transparency and accountability in financial practices across all businesses operating in Belgium.

Hiring personnel in Belgium is a straightforward process, characterized by a well-regulated labor market and a highly skilled workforce. The Belgian labor force is known for its strong work ethic, high educational standards, and proficiency in multiple languages, including French, Dutch, and English, especially among younger professionals.

Belgium has numerous recruitment agencies specializing in various sectors, giving businesses access to a diverse talent pool. These agencies have a deep understanding of the local job market, facilitating efficient recruitment processes for companies seeking skilled personnel.

The Belgian labor market offers flexibility, allowing for a range of employment contracts, including full-time, part-time, and temporary positions. This flexibility enables companies to tailor their workforce to meet operational needs and market demands.

Online job portals, professional networking sites, and social media are widely used in Belgium to post job advertisements. Utilizing these platforms helps businesses reach a broad audience, making them particularly effective for startups and small businesses looking to attract potential employees.

Belgium has specific labor laws that govern the hiring process, including regulations on non-discrimination, data protection, and fair employment practices. Companies must comply with these laws to ensure a fair recruitment process. Seeking legal advice or assistance from HR service providers can be beneficial for navigating these regulations.

Belgium features a regulated minimum wage system that ensures fair compensation for all workers. Employers should be aware that wages in Belgium can be relatively high compared to other countries, which impacts budgeting and financial planning.

Employers in Belgium are obligated to provide certain benefits, such as paid sick leave, parental leave, and holiday entitlements, contributing to a high standard of employee rights. While these protections enhance worker security, they can also impose additional responsibilities and costs on employers.

Intellectual property (IP) protection in Belgium is robust and governed by both national laws and European regulations. Businesses can safeguard their innovations through various IP rights, including patents, trademarks, copyrights, and designs. The Belgian Intellectual Property Office (OPRI) oversees the registration and enforcement of patents and trademarks in Belgium.

To obtain a patent in Belgium, an invention must meet specific criteria: it must be novel, involve an inventive step, and be industrially applicable. Trademarks can be registered for goods and services to protect brand identity and prevent unauthorized use by competitors.

Belgium is also a signatory to international agreements such as the Paris Convention and the TRIPS Agreement, which establish a framework for protecting IP rights across borders. Businesses are encouraged to conduct comprehensive IP audits to identify and safeguard their intellectual assets. Seeking legal advice from IP specialists can help ensure compliance with relevant laws and enhance the effectiveness of protection strategies.

Understanding the regulatory landscape concerning permits and licenses in Belgium is essential for businesses, entrepreneurs, and individuals looking to navigate the legal framework effectively. This landscape is characterized by various regulations at federal, regional, and municipal levels, each playing a crucial role in the approval process for different types of activities. Here's a comprehensive overview:

Federal, Regional, and Local Authority

Belgium has a complex political structure with three regions—Flanders, Wallonia, and Brussels-Capital—each possessing varying degrees of legislative power. Consequently, permits and licenses can differ significantly based on the region.

Federal Level: This level handles overarching regulations, especially for sectors like finance, pharmaceuticals, and environmental protection. Specific licenses, such as those related to labor laws and corporate governance, fall under federal jurisdiction.

Regional Level: Each region has its own authorities and regulations concerning urban planning, environmental protection, and economic activities. For instance, Flanders has the Flanders Investment and Trade agency, while Wallonia has the Walloon Export-Investment Agency.

Local Authority: Municipalities have their own bylaws and regulations concerning local businesses, zoning, and specific licenses such as operating a restaurant, building permits, and event permits.

Types of Permits and Licenses

Business Licenses

Construction and Urban Planning Permits

c. Professional Licenses

Certain professions, such as healthcare practitioners, legal professionals, and financial advisors, require specific qualifications and licenses to operate legally.

d. Event Permits

Application Process

The application process for permits and licenses in Belgium often involves several steps:

We see the great possibilities this strategic site presents for worldwide entity management services as we start this fascinating path of opening our new branch in Belgium. Apart from its central location inside Europe, Belgium distinguishes itself for its strong economic environment and dedication to creativity. Using these benefits will help companies to grow and run confidently.

Our emphasis on offering first-rate client services for Belgian entity administration guarantees that businesses can negotiate the local terrain with ease. From entity creation and compliance to continuous operational support, our committed staff is ready to satisfy the particular requirements of both EU and non-EU companies. Providing individualized solutions catered to their particular needs, we are dedicated to enable our customers flourish in an ever-changing market.

All things considered, Belgium is more than just a key site; it's a portal to a universe of possibilities for companies trying to be very visible in Europe. Supporting your entity management requirements and enabling you to fully utilize your operations in an energetic nation excites us.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!