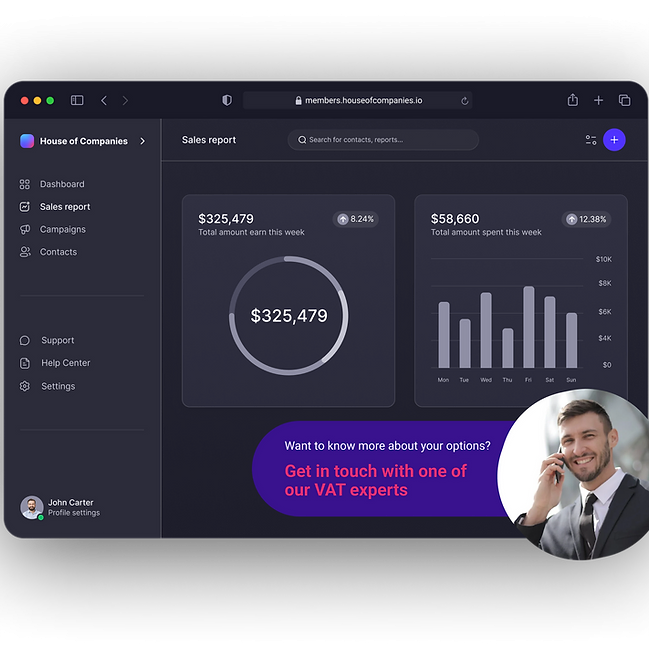

Manage your corporate tax filings and other business challenges in Belgium with ease using our streamlined control panel. The most cost-effective and efficient solution to file your Belgian corporate tax return, without the need for overseas tax lawyers—keeping you in full control or working directly with your current accountant.

Submitting your corporate tax returns in Belgium is becoming simpler every day. With more online tax portals available, global entrepreneurs can easily file their corporate tax returns. Try our Entity Management services to submit your corporate tax return in Belgium during a Free Trial.

Once your tax return is filed, you can continue using Entity Management to manage and grow your business in Belgium!

"Entity Management made submitting my corporate tax return in Belgium fast, simple, and stress-free."

Global Talent Recruiter

Global Talent Recruiter"Thanks to Entity Management, I filed my taxes effortlessly, saving time and avoiding errors."

Spice & Herbs Export

Spice & Herbs Export"The Free Trial allowed me to experience seamless corporate tax submission, with exceptional support and guidance."

IT firm

IT firmWhile our Entity Management service is comprehensive, some situations may require specialized local expertise. In Belgium, a local accountant is often legally required. House of Companies can assist you in submitting your corporate tax return. Whether you provide us with your ledgers, Profit & Loss statement, and Balance Sheet, or ask us to start from scratch, our expert team is here to ensure compliance. Our International Tax Officers are ready to handle complex tax matters that may go beyond the scope of standard entity management services.

1. Do I need a local accountant to submit my corporate tax return in Belgium?

Yes, in Belgium, a local accountant is often required to submit corporate tax returns. We can provide professional assistance with this process.

2. What documents do I need to submit for the corporate tax return?

You can provide us with your financial documents, such as ledgers, Profit & Loss statement, and Balance Sheet. Alternatively, we can assist you in preparing everything from scratch.

3. How can House of Companies help with my corporate tax return in Belgium?

We can handle the entire process, from gathering your financial information to ensuring your tax return is filed correctly and on time, all in compliance with Belgian tax laws.

4. What if my business has complex tax matters?

Our International Tax Officers specialize in managing complex tax issues, including personal tax affairs, that may not be covered by basic entity management services.

5. Are there any penalties for late submission of corporate tax returns in Belgium?

Yes, there can be penalties for late submission or inaccurate filings. It is important to submit your corporate tax return on time, and our team can help ensure compliance and avoid penalties.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!