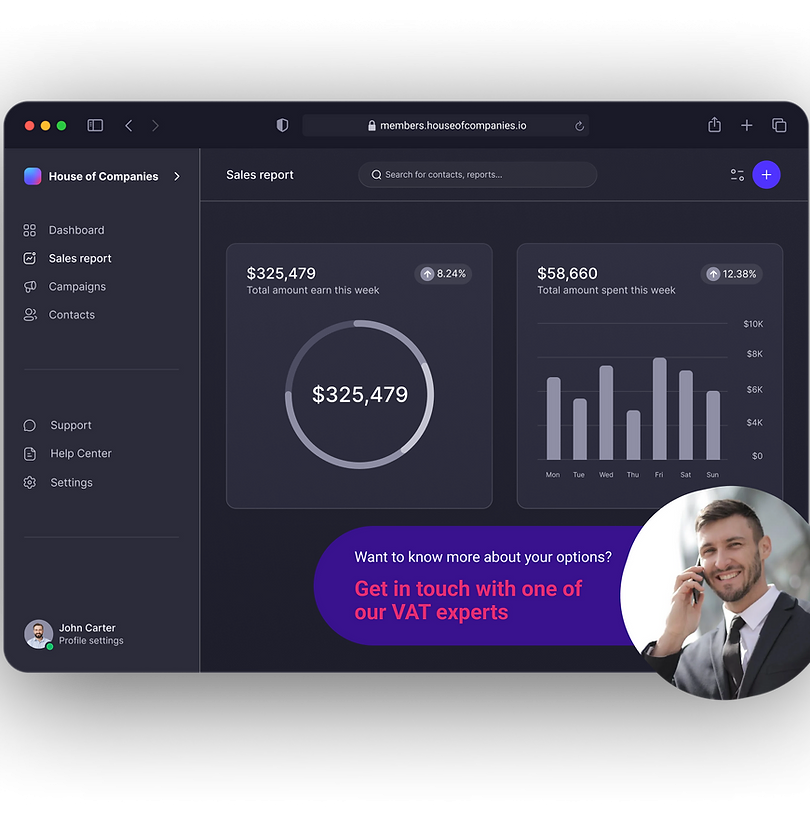

Without a local organization, or even an accountant, I solved my VAT ID application.

Global Talent Recruiter

Global Talent RecruiterDealing with Amazon required a VAT ID, therefore the outcome is great.

Spice & Herbs Export

Spice & Herbs ExportNo local company; I needed a VAT number. I needed no accountant as I just had few transactions, and the Launch Grid lets me easily file all returns!

IT firm

IT firm

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!