In Belgium, non-resident companies often find it challenging to navigate the complex landscape of accounting and tax regulations.

Belgian accounting firms assist foreign companies and individuals in managing their financial affairs while conducting business in the country. These firms play a crucial role in ensuring compliance with Belgian tax laws and regulations. They provide essential services, from obtaining a VAT number to filing annual financial reports. This support is critical for foreign entities to meet their financial obligations in Belgium.

This article delves into the key aspects of accounting and tax compliance for non-residents in Belgium and highlights how House of Companies has streamlined and simplified Belgian accounting practices.

It covers important topics such as corporate income tax, bookkeeping regulations, and the participation exemption. By understanding these components, non-resident companies can manage their financial matters effectively and capitalize on opportunities within the Belgian business environment.

If you are looking to boost your business profits, our Increase Your Profits with Dutch Accounting in Belgium service is tailored to meet your needs. We specialize in combining the best practices of Dutch accounting with the specific requirements of businesses operating in Belgium. With an in-depth understanding of the financial landscapes in both countries, our team is equipped to provide customized solutions that enhance your profitability.

Our expertise ensures efficient management of your financial records while maintaining full compliance with Belgian regulations. By adopting effective accounting strategies, we can identify opportunities to reduce costs and increase your revenue. Our services extend beyond basic bookkeeping—we thoroughly analyze your financial data to deliver insights that lead to smarter, more profitable business decisions.

We also handle VAT returns, ensuring that all eligible deductions are claimed to minimize your tax liabilities. Our goal is to simplify accounting for you, so you can focus on running and growing your business. With our support, you can streamline your financial processes, leading to significant cost savings and higher profit margins.

If you are one of our clients in need of our Increase Your Profits with Dutch Accounting in Belgium service, you can count on personalized, hands-on assistance. We are dedicated to helping you reach your financial objectives while providing clear, consistent communication and guidance. Let us help you unlock your business’s full potential in Belgium with our expert accounting services.

Belgian accounting regulations are governed by a combination of national laws and European Union directives, ensuring that businesses follow consistent and transparent financial reporting standards. The main framework is based on Belgian GAAP (Generally Accepted Accounting Principles), which primarily applies to non-listed companies, while listed companies are required to follow IFRS (International Financial Reporting Standards) for consolidated financial statements.

The Belgian Companies Code and various Royal Decrees, particularly the Royal Decree of 30 January 2001, outline the basic rules for financial reporting. All businesses must maintain their accounts using the double-entry bookkeeping system, and they must follow a uniform chart of accounts, ensuring consistency in recording transactions. Financial statements, including the balance sheet, income statement, and notes, must be prepared annually.

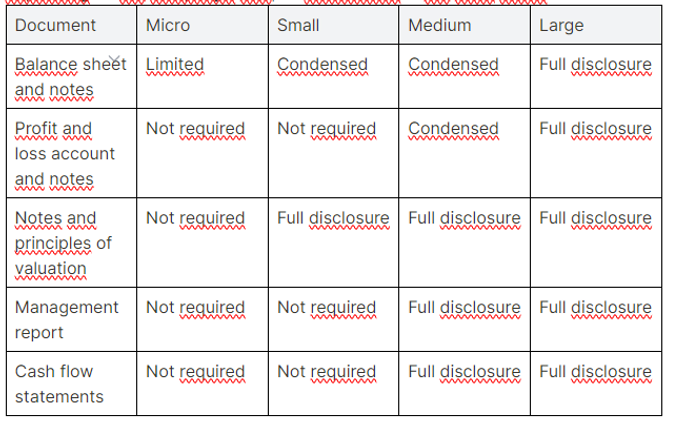

The level of financial reporting required depends on the size of the company. Small companies are subject to simplified reporting requirements, only needing to file abbreviated financial statements. Medium and large companies must provide more detailed reports, and if they control other entities, they are required to submit consolidated financial statements.

Auditing is mandatory for medium and large companies, as well as public interest entities, but small companies are generally exempt unless they exceed certain financial thresholds. Statutory auditors, registered with the Institute of Registered Auditors, must review these statements to ensure compliance.

Companies must file their financial statements with the National Bank of Belgium (NBB) within seven months after the financial year ends, where the documents are made publicly accessible. With increasing digitization, initiatives like e-invoicing and a growing focus on corporate governance are shaping the future of accounting in Belgium, ensuring transparency and efficient practices.

Belgium offers a variety of legal entity types that are accessible to non-residents seeking to establish a business presence in the country. Understanding these options is crucial for foreign entrepreneurs looking to operate effectively within Belgium's robust economic framework.

The most common legal entity types available to non-residents include:

Private Limited Liability Company (BV): This structure is ideal for small to medium-sized enterprises. It provides limited liability protection to its shareholders, making it a popular choice for foreign investors.

Public Limited Company (NV): Suitable for larger businesses, the NV allows for the raising of capital through the issuance of shares. This entity type is often chosen by non-residents looking to attract investment.

Branch Office: A branch office allows non-residents to conduct business in Belgium without establishing a separate legal entity. This option is advantageous for companies wanting to test the market before fully committing.

Representative Office: This type serves as a liaison for the parent company, allowing non-residents to promote their products and services without engaging in direct commercial activities.

Our customer services are designed to support businesses in selecting the most appropriate legal entity for their operations in Belgium. We provide expert guidance on the registration process, compliance requirements, and ongoing support to ensure that non-residents can successfully establish and grow their business in this vibrant market.

Establishing a branch office in Belgium brings several accounting implications that businesses must consider to ensure compliance and operational efficiency. As a central hub in Europe, Belgium offers a favorable business environment, but it also has specific regulations that govern financial reporting and taxation for branch offices.

When a business registers a branch in Belgium, it is required to maintain separate accounting records for that branch. This includes tracking income and expenses accurately to reflect the branch’s financial activities. Additionally, businesses must adhere to Belgian accounting standards, which may differ from those in their home countries. This often requires a thorough understanding of local financial regulations to ensure compliance.

Tax implications also play a critical role in the accounting landscape. Branch offices in Belgium are subject to corporate income tax on profits generated within the country. Understanding the nuances of tax obligations, including potential deductions and credits, is essential for effective financial management.

Our customer services for businesses operating in Belgium include comprehensive accounting support tailored to meet these specific needs. We assist with setting up accounting systems, ensuring compliance with local regulations, and providing ongoing financial reporting services. With our expertise, businesses can confidently establish their branch offices in Belgium, knowing that their accounting and financial obligations are well-managed.

Understanding tax registration in Belgium is crucial for businesses aiming to operate in this dynamic market. Companies must register with the Belgian Tax Administration for a unique tax identification number, covering corporate tax, VAT, and local taxes. Our services streamline this process, ensuring compliance and allowing businesses to focus on growth.

In Belgium, understanding and managing Value Added Tax (VAT) is crucial for businesses engaged in VAT taxable transactions. Our new branch in Belgium specializes in providing comprehensive VAT services tailored to meet the specific needs of companies operating within this jurisdiction.

Belgium’s VAT system is characterized by specific regulations and compliance requirements that businesses must adhere to in order to remain compliant and avoid penalties. Our dedicated team offers expert guidance on VAT registration, filing, and reporting, ensuring that businesses are fully aware of their obligations and can effectively manage their VAT liabilities. We provide insights into applicable VAT rates, exemptions, and cross-border considerations, allowing businesses to optimize their VAT position.

With our customer-focused approach, we are committed to supporting businesses in Belgium by simplifying the complexities of VAT compliance. Our goal is to help you achieve seamless operations while maintaining full compliance with Belgian VAT regulations, ultimately contributing to your business success in the region.

When operating a business in Belgium, registering as an employer is a crucial step for managing payroll for your staff. This process ensures compliance with local labor laws and tax regulations, providing a solid foundation for your business operations.

Belgium offers a comprehensive framework for businesses to establish themselves as employers, allowing them to hire and manage employees effectively. Our customer services are tailored to assist companies in Belgium with all aspects of employer registration, including the preparation of necessary documentation, understanding payroll obligations, and ensuring adherence to labor regulations.

By partnering with us, businesses can streamline their registration process, allowing them to focus on growth and success in the Belgian market. Our dedicated team is here to provide the support needed to establish a strong employer presence in Belgium, ensuring that your payroll operations run smoothly and efficiently.

Resident companies in Belgium are subject to corporate income tax on their worldwide income.

The standard corporate income tax rate is 25%, with a reduced rate of 20% applicable to small businesses on the first €100,000 of taxable income. Companies must file annual corporate income tax returns and make advance payments throughout the year.

Non-resident companies are liable for corporate income tax only on their Belgian-source income, which includes profits attributed to a permanent establishment in Belgium. These companies are required to file corporate income tax returns and pay taxes on their taxable income.

An important consideration is: Is my company considered resident in Belgium? Generally, any company incorporated under Belgian law is deemed a resident unless there is a tax treaty in place or the substance requirements are not met.

This means that, in theory, you can operate a Belgian business without reporting your profits in Belgium, instead reporting them in the country where the company’s effective management and control take place. For more insights on this topic, check out our blog!

Non-resident entities operating in Belgium are subject to various bookkeeping and financial reporting obligations under Belgian law. These requirements are primarily governed by the Belgian Companies Code (Code des sociétés et des associations or Wetboek van Vennootschappen en Verenigingen) and Belgian Generally Accepted Accounting Principles (Belgian GAAP).

Almost every Belgian corporate entity is required to prepare financial statements in accordance with the law, typically outlined in the entity's statutes.

The financial statements serve as a crucial component of the Belgian legal framework and form the basis for corporate governance. They are also significant for taxation purposes, as they provide the foundation for determining the taxable base, although tax regulations operate under independent rules.

Depending on the company's size and publication requirements, financial statements in Belgium generally must include at least:

The financial statements should accurately reflect the company's financial position, and the accounting principles applied must be clearly outlined within the statements. These principles can only be changed for valid reasons, and any such changes, along with their impact on the company's financial position, must be disclosed in the notes.

Parent companies in Belgium are generally required to include the financial data of "controlled subsidiaries" and other "group companies" in their consolidated financial statements.

A "controlled subsidiary" refers to a legal entity in which the parent company can directly or indirectly exercise more than 50% of the voting rights at the shareholders' meeting, or is empowered to appoint or dismiss more than half of the managing and supervisory directors.

Consolidation may be omitted under certain conditions, such as when the subsidiary or group company qualifies as a small company under Belgian statutory regulations or when its financial information has been incorporated into the parent company’s consolidated financial statements prepared in accordance with the Belgian Company Code or relevant EU directives.

In Belgium, only medium and large companies, as well as those that are publicly traded or prepare their financial statements in accordance with International Financial Reporting Standards (IFRS), are legally required to have their annual accounts audited by an independent, qualified, and registered auditor.

The auditor's report must confirm whether the financial statements comply with generally accepted accounting principles in Belgium and accurately reflect the company’s financial position and results for the year.

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!